We will be taking a look at the Investment Case for JD.Com, Inc (JD) in this write-up. It is the 9th entrant into the Actionable Set-ups series, this time for the Medium-term.

Layout:

Overview of JD.Com

Management

Financials and Valuation

Chart

My current position and plans

Be sure to also check out my most recent Monthly Market Memo and Portfolio Update below:

Overview

JD.com, Inc is a technology-driven e-commerce company headquartered in Beijing, China, and is recognised globally as the largest retailer in China, a member of the NASDAQ-100, and a Fortune Global 500 company.

The company’s official mission, ‘Making Lives Better through Technology,’ highlights its core strategy: leveraging advanced technology—especially its superior supply chain and logistics infrastructure—to improve the customer experience and drive efficiency across various sectors

The investment case for JD.com Inc. centres on its strong position as one of China’s largest e-commerce retailers, supported by a superior, in-house logistics and supply chain network, and its commitment to quality and authenticity.

Core Business

JD’s primary business is JD Retail, which operates an online platform for direct sales of a wide range of products—including electronics, home appliances, general merchandise, and fresh produce. It is known for its direct sales model where it purchases inventory and sells it directly to consumers. This helps to ensure quality and control over the supply chain.

JD.com Revenue Streams:

Product Revenue: Sales of merchandise from its direct retail model. This is the largest contributor.

Service Revenue: The company’s service revenues are diversified, including marketplace services, logistics and fulfillment (offered to its own retail segment and external third-party customers through JD Logistics), and advertising/marketing services. Separately, JD Health leverages JD.com’s supply chain strengths to focus on online healthcare services, such as consultations and pharmacies. (JD.com retains approximately 80% control in JD Health.)

Bull Case:

Improving Profitability:

The company has stated they are focused on improving margins and operational efficiency through technological improvements, including greater use of AI for personalised recommendations and logistics optimisation.

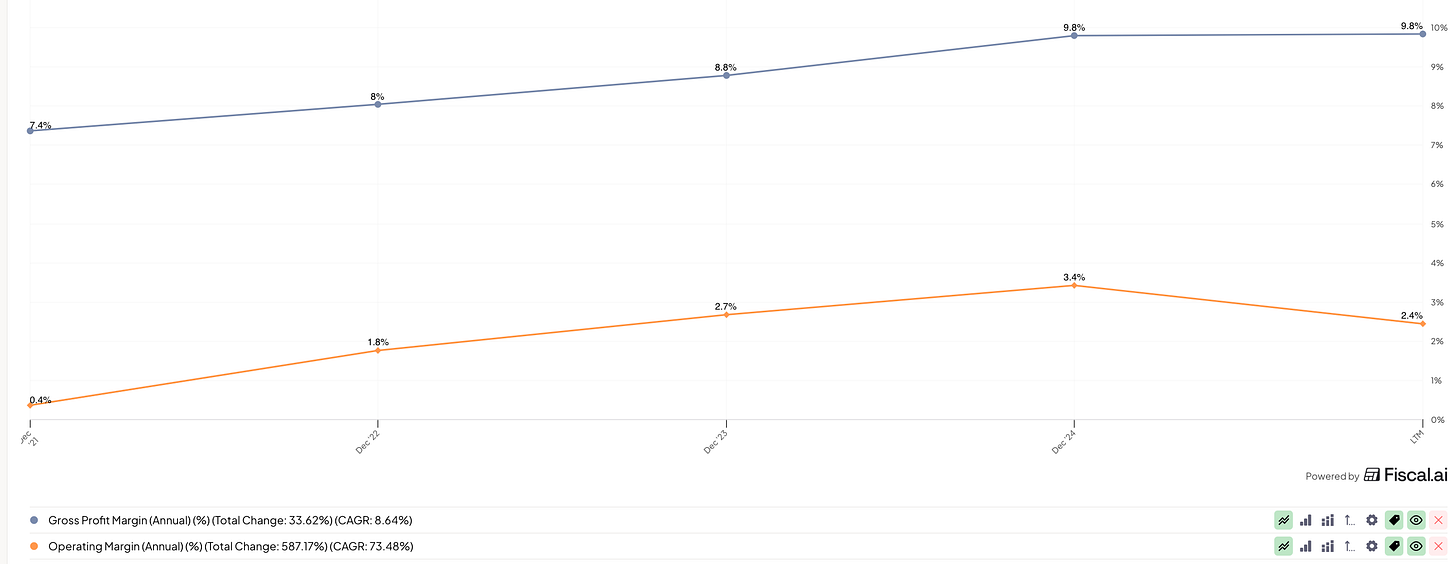

Gross margins and operating margins had both increased every year since 2021, but operating margin declined in the last twelve months (LTM) period.

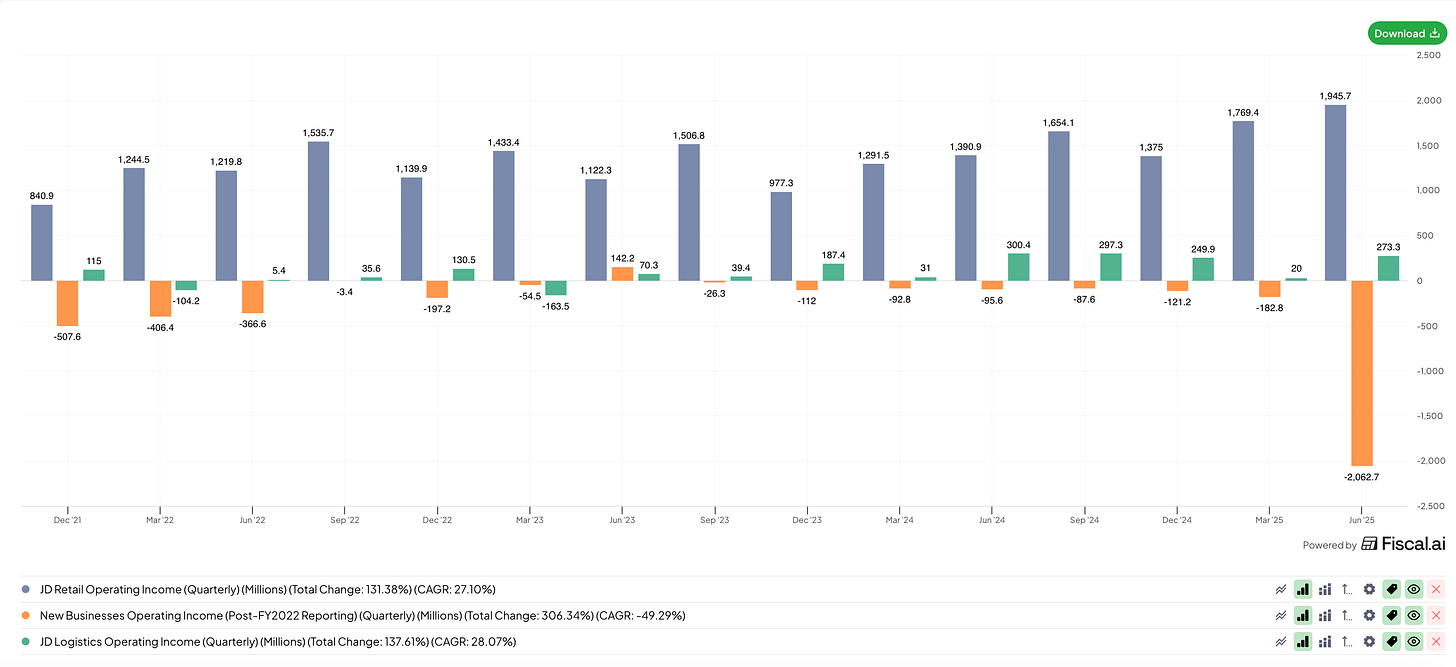

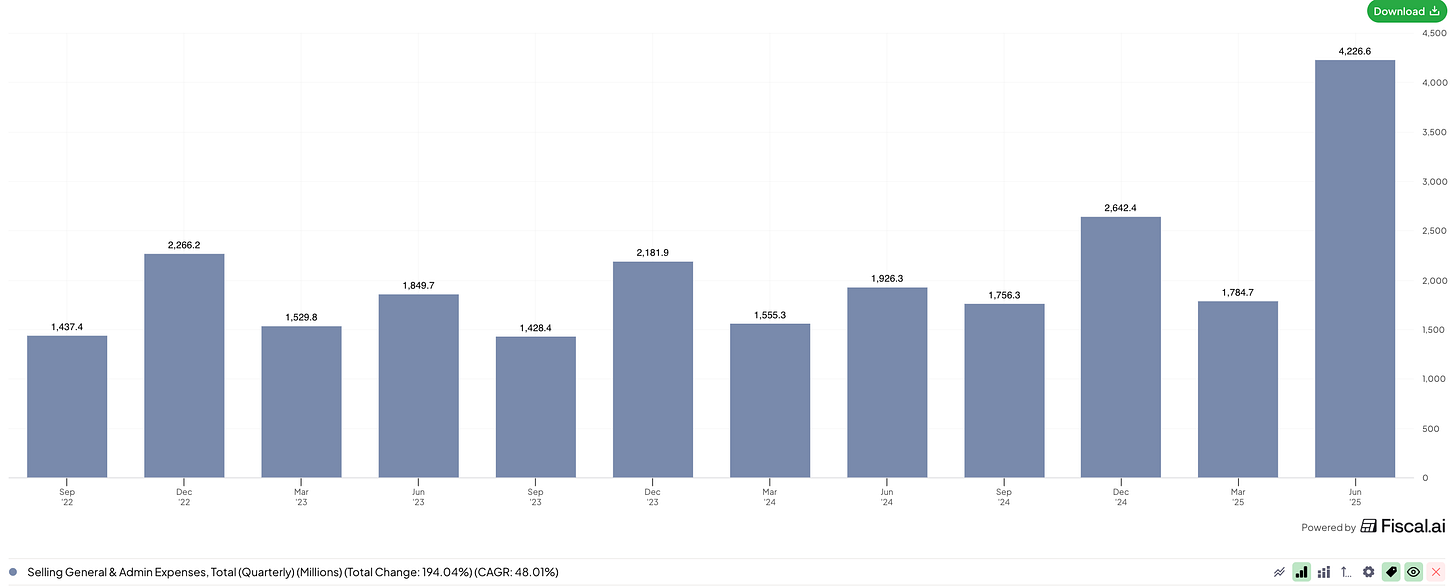

In the most recent quarter, operating income did flip from a profit to a loss. This reversal was largely due to massive investment in the food delivery business, which caused Selling, General, and Administrative (SG&A) expenses (particularly Marketing) to increase dramatically. While this increase offset the strong profitability of the Core Retail business, analysts project that these losses from food delivery will begin to reduce in coming quarters, thus benefiting overall profitability.

Logistics Advantage:

JD Logistics offers a vast, proprietary, and highly efficient network of warehouses and delivery personnel that covers nearly all of China. This infrastructure is a competitive advantage and a growing source of external service revenue.

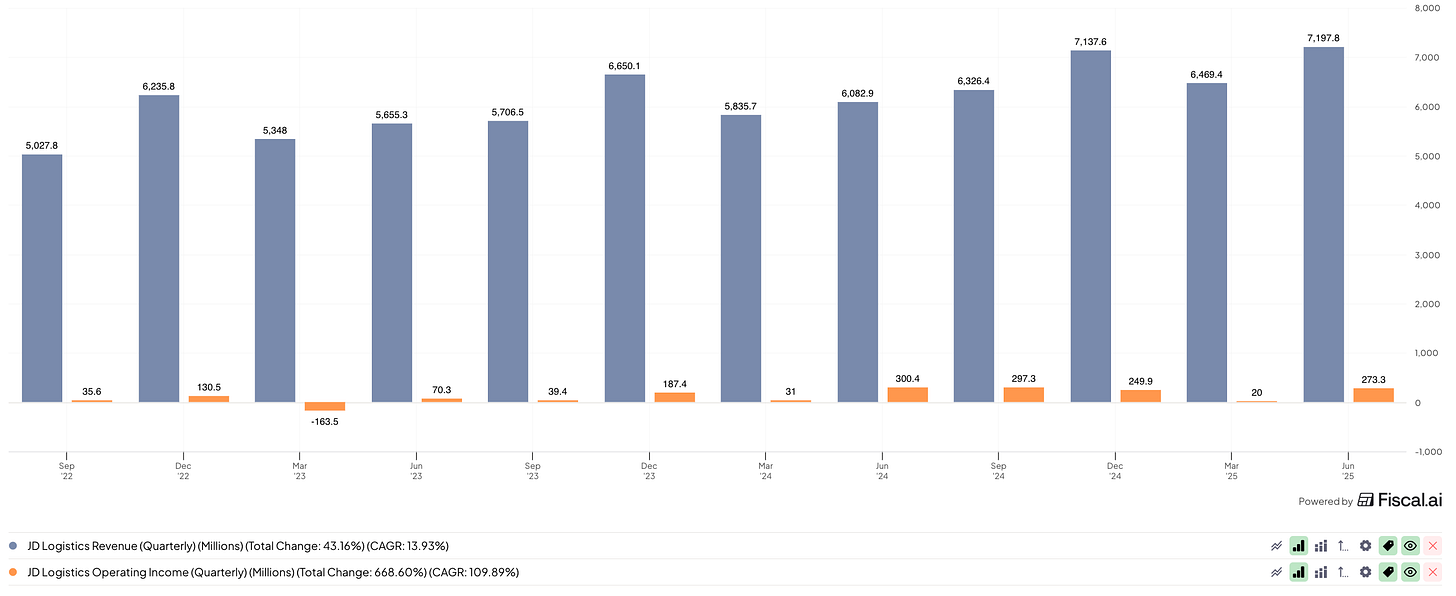

The chart below shows that JD Logistics is consistently growing and has been profitable, on an Operating Income Basis, for 11 of the last 12 quarters. Q4 tends to be the strongest.

Diversification and Ecosystem Growth:

JD’s expansion into high-growth areas like JD Health (digital health services) and JD Industrials (industrial supply chain technology) provides new long-term growth drivers. The push into the competitive food delivery market could also be a way to cross-sell to new users and leverage its logistics network.

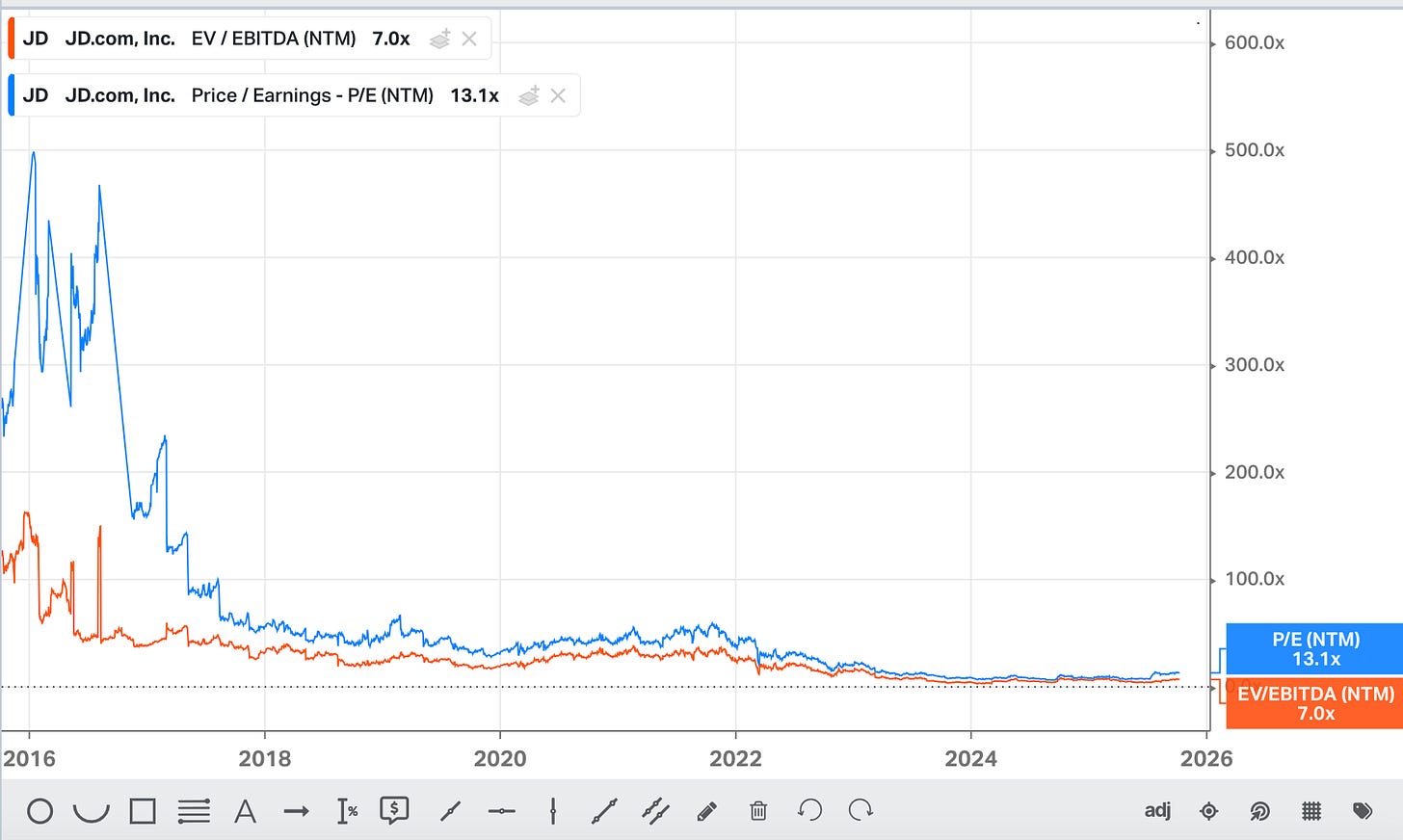

Low Valuation: Trades at 7x EV/EBITDA and ~9x FY26 projected EPS. This puts it in the bottom decile valuation wise in it’s history. We will discuss Valuation more further along. It is interesting to note MorningStar has a fair valuation of $60 for JD, this implies >70% upside.

China Bull Market:

A rising tide lifts all boats, and Chinese equities are currently amidst a bull run. BABA is up 113%, BIDU 66%, PDD 37%, and KWEB is up 46% YTD; meanwhile, JD is only up 1% YTD. I believe the gap will close and JD will catch up some.

The Bear Case (Risks & Concerns)

Intense Competition:

We know that JD faces stiff competition in the e-commerce sector from rivals like Alibaba ($BABA) and especially Pinduoduo ($PDD). This intense competition can pressure margins through price wars and market share loss, making differentiation critical for JD’s future success.

Expansion Costs and Losses:

The company’s recent expansion into new sectors, such as food delivery, has resulted in significant operating losses and cash flow contraction due to heavy investments and subsidies. Whilst expected to minimise in coming quarters, it is unknown to what extent. Furthermore, the ROI on this spend is yet to be reflected.

Geopolitical and Regulatory Risks:

As with all Chinese ADRs listed in the U.S., JD.com remains exposed to significant risks, including U.S.-China trade tensions, potential Chinese regulatory changes, and the persistent threat of U.S. delisting. Consequently, JD’s valuation will likely always be discounted. However, I believe the risk of a delisting is very low and do not anticipate one under President Trump’s presidency, especially given the recent signs of improving relations.

Management

Richard Qiangdong Liu is the Founder and Chairman of JD.com. He guided the company’s development for decades and remains a significant figure in the business today.

The Chief Executive Officer (CEO) is Sandy Ran Xu, who was appointed to the role in May 2023. Prior to becoming CEO, Ms. Xu served as the company’s Chief Financial Officer (CFO) from 2020 to 2023 and has a strong financial background, having spent nearly 20 years as an audit partner at PricewaterhouseCoopers (PwC).

Financials

At the time of writing, JD has a Market Cap of $49.73B with Cash & Inv. of $29.85B and Debt of $14.07B. Net Cash position is good to see and Cash & Inv accounts for almost 60% of the market cap.

TTM Performance:

Revenue TTM: $177.7 (B)

Gross Profit TTM: $17.47B

Operating Income TTM: $4.33B

Net Income TTM: $5.43B

Q2 2025 Highlights:

Revenues of $49.8B which represented a 22.4% increase YOY

Operating Loss of $151.2M which swung from Operating Income of $1.45B in the year ago period (Q2 24)

GAAP Net Income of $862M down from $1.74B the prior year in the same period.

Cash flow from Operations $3.41B down from $6.98B the prior year in the same period

Free Cash Flow of $2.98B down from $6.52B the prior year in the same period.

Valuation:

JD trades at:

0.2x LTM EV/S and 0.2x NTM EV/S.

4.3x LTM EV/EBITDA, 7x NTM EV/EBITDA and ~6x FY26 EBITDA.

9.8x LTM PE, 13.1x NTM PE and ~9x PE on FY26 projected numbers,.

44x P/FCF, 10.9x NTM EV/FCF and 10.4x FY26 projected FCF.

The Trailing FCF multiples may seem higher than we would expect, but it must be noted that FCF has been impacted by the significant Investments in its New Business Line. We should expect this to normalise.

Furthermore, its earnings multiple comfortably sit in the lowest decile in the last decade whilst still growing revenue and EBIT meaningfully throughout that time.

Capital Returns:

JD has an ongoing share buyback program of up to $5B which started in September 2024 and will continue through AUgust 2027. This has had a material effect and shares outstanding are currently at 1.42B, they were as high as 1.57B when initiated.

JD.com pays out aDividend which yields 2.87%.

Clearly, JD is an inexpensive, growing company that is returning capital to shareholders. This capital return should boost investor confidence. The top and bottom lines are expanding, with EPS expected to nearly double between FY25 and FY27. Furthermore, JD’s low Beta of 0.4 implies the stock is less volatile than the overall market and could serve as a more ‘defensive’ asset.

Chart:

At the time of writing JD trades at $34.88 RSI 53.22 6.08% above the ascending SMA 50 and 0.67% below the flattening 200SMA.

+2% YTD

I like that the stock picked up off the bottom following their most recent ER in August and the 20SMA has crossed over the SMA 50.

Clearly, this chart needs a lot of work and time, but I will consider adding a test of the SMA 50. To my eyes, a realistic initial upside target from a technical perspective is a move to $45.

My current position and plans

I am currently long shares at an average cost of $34.7. It is a ~3.5% position for me.

I plan to hold this position as a medium-term swing trade. I may add in the low 30’s and would trim some if an upside targets are reached. As always, I will update all transactions live for this position and all others in subscriber channels.

Thank you for reading and if you enjoyed this post, please leave a like and Restack.

Subscribe to the plan that best suits your needs (free or premium), and I’ll see you in the next one!

Don’t want more that one Chinese stock in portfolio

Good write-up! You make a compelling case.

But I cant help but think, why not invest in BABA or PDD? Is it purely valuation or the fact JD is yet to run up?

Have you also considered other Asain behemoths like Sea and Coupang? I also really like their growth stories and they seem to be in a better place than JD